Ready to Buy or Sell a Home? Here Are 5 Key Factors in Choosing the Right Agent

Navigating the real estate market without guidance is like starting an expedition without a map. Whether you're selling your cherished family home or searching for your dream property, having the right real estate agent by your side can make all the difference.

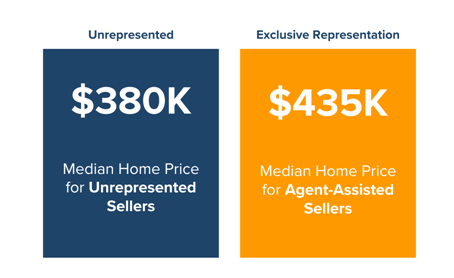

According to a 2024 report from the National Association of Realtors, agent-represented homes sold for a median price of $435,000, compared to just $380,000 for those sold by owners alone.1

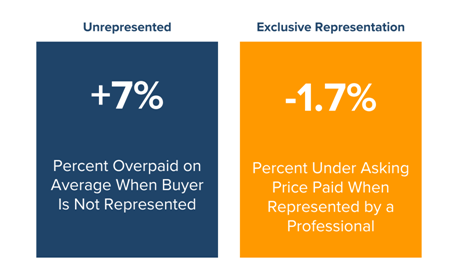

But home sellers aren’t the only ones who can benefit. A study by the Consumer Federation of America found that homebuyers can save significantly by working with an agent dedicated to their interests.2

While it’s easy to see the advantages of working with a real estate professional, it can be challenging to find the right representative whose expertise, service, and terms align with your specific needs. This comprehensive guide presents five factors to consider when choosing a real estate agent who can deliver results while streamlining the process.

Buyer’s Agent vs. Listing Agent: What’s the Difference?

A buyer’s agent represents the interests of the homebuyer. Their role includes helping you find properties that meet your criteria, coordinating viewings, negotiating offers, and guiding you through inspections and closing. They are your advocate throughout the purchasing process.

A listing agent, on the other hand, represents the seller. They are responsible for pricing the home competitively, marketing the property, managing showings, and negotiating with buyers on your behalf. Their job is to sell your home with the best possible terms.

In most cases, homeowners who are selling their current property and buying a new one can work with the same agent for both transactions. This offers convenience and consistency, as your agent will have a full understanding of your timeline, financial goals, and property preferences. However, if you’re relocating to a different city or state, you may need to work with two separate agents—one to list and sell your current home and another with local expertise in your new area to assist with your purchase.

1. Credentials & Reputation

A well-qualified agent brings more than just enthusiasm; they bring training, experience, and a proven track record.

First, check that the agent holds a valid license through your state's real estate commission. Licensed real estate agents must complete state-approved education courses, pass a licensing exam, and stay current with the latest laws and market practices. They are also bound by state regulations and ethical codes, particularly if they are members of the National Association of Realtors.3

Next, inquire about the agent’s continuing education. Real estate designations and certifications indicate additional training and a commitment to excellence in specific areas of real estate.

When it comes to reputation, don’t hesitate to ask for references and check online reviews. Past clients can provide insight into the agent’s communication style, negotiation skills, and ability to manage complex transactions. Prioritize any feedback you receive from trusted family and friends.

Additionally, take time to visit the agent’s website and social media channels to see if they regularly share useful and relevant real estate information, such as market updates, home buying and selling tips, or neighborhood insights. A well-maintained online presence not only reflects their commitment to staying engaged in the industry but also shows they are a resource for their clients before, during, and after a transaction.

2. Local Market Knowledge

One of the most valuable assets a real estate agent can offer is in-depth knowledge of the local market. Whether you're buying or selling, working with someone who understands the neighborhoods, pricing trends, school districts, amenities, and zoning regulations in your target area can give you a significant edge.

A local market expert can help sellers price their home competitively, attract the right buyers, and highlight community features that add value. For buyers, a locally knowledgeable agent can identify hidden gems, alert you to upcoming developments that may impact property values, and advise on which areas offer the best long-term investment potential.

They also tend to have established relationships with local lenders, inspectors, contractors, and other professionals, which can make the entire process smoother and more efficient. When choosing your agent, ask how long they’ve worked in the area and what insights they can offer about your specific neighborhood or region.

3. Service & Value Proposition

Not all real estate agents offer the same level of service, so it’s important to understand what sets one apart from another. Take time to evaluate an agent’s unique value proposition—what they promise to deliver that others may not. This can help you choose someone whose approach and strengths align with your specific needs.

If you're selling a home, ask for a written copy of their marketing plan. What steps will they take to reach qualified buyers? Find out how they determine pricing and how actively they will communicate with you throughout the transaction.

For buyers, consider how the agent searches for properties, how quickly they can schedule showings, and whether they can help you compete in a competitive market. Do they offer guidance on financing, local insight on neighborhoods, or access to off-market listings?

An effective agent should be able to clearly articulate the value they bring, backed by experience, data, and a commitment to personalized service. Ask for a breakdown of their services upfront to ensure you understand what to expect from the partnership.

4. Terms of Representation

Before committing to an agent, it’s essential to understand the terms of your working relationship. Clarify who will be your primary contact and how and when they will communicate with you throughout the process. The best real estate agents establish clear communication protocols and consistently meet or exceed expectations throughout the relationship.

Most agents will ask you to sign a contract that outlines their duties, your obligations, and the scope of services provided. Take time to review the terms carefully and ask questions.

For sellers, the agreement may include the listing price, compensation terms, and the duration of the contract.4 Buyers typically sign a representation agreement, which confirms the agent is working in their best interest during the home search and purchase process.5

Always thoroughly review any buyer or seller agency agreement for termination clauses and commission obligations before signing. Trustworthy agents are transparent about their compensation structure and willing to explain how it aligns with your goals.

5. Ongoing Support

Exceptional agents continue to provide support long after closing. A top-tier real estate professional offers ongoing support, ensuring you have a trusted resource long after the transaction is complete.

Some agents are willing to provide post-purchase assistance, such as recommending reliable contractors, helping you understand your property tax assessments, or offering periodic home value analyses. For sellers, they may provide advice on reinvestment options or an agent referral if you’re planning to move to a new area.

This continued relationship can be especially valuable if you’re new to the area or plan to buy or sell again in the future. Ask potential agents how they stay in touch with past clients and whether they offer any resources or services to support you after closing. An agent who sees the relationship as long-term is one who genuinely values your trust and satisfaction.

READY TO MAKE YOUR MOVE? LET’S TALK.

Choosing a real estate agent is one of the most important decisions you'll make when buying or selling a home. The right partner can make the process easier to navigate and more rewarding, both financially and emotionally.

If you're looking for an experienced, locally knowledgeable agent who prioritizes clear communication, personalized service, and proven results, we’d love the opportunity to earn your trust.

Schedule a free, no-obligation consultation today to discuss your goals, ask questions, and find out how we can help you navigate your next move with confidence. Let’s turn your real estate goals into a successful reality—together.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

1. National Association of Realtors -

https://www.nar.realtor/magazine/real-estate-news/fsbos-reach-all-time-low-more-sellers-rely-on-agents

3. Investopedia -

https://www.investopedia.com/investing/steps-becoming-real-estate-agent/

4. National Association of Realtors -

https://www.nar.realtor/the-facts/consumer-guide-listing-agreements

5. National Association of Realtors -

https://www.nar.realtor/sites/default/files/2024-08/consumer-guide-written-buyer-agreements-2024-08-24.pdf