8 Strategies to Secure a Lower Mortgage Rate

Mortgage rates have been on a roller coaster ride this year, rising and falling amid inflationary pressures and economic uncertainty. And even the experts are divided when it comes to predicting where rates are headed next.1

This climate has been unsettling for some homebuyers and sellers. However, with proper planning, you can work toward qualifying for the best mortgage rates available today – and open up the possibility of refinancing at a lower rate in the future.

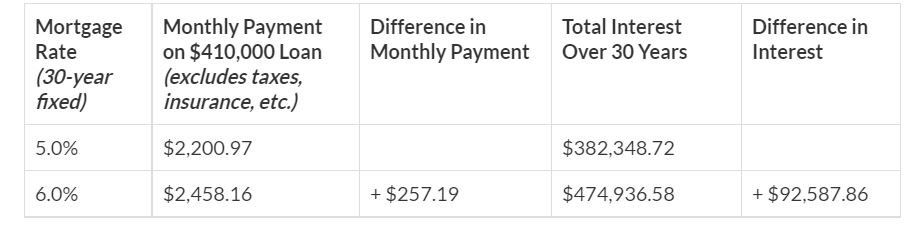

How does a lower mortgage rate save you money? According to Trading Economics, the average new mortgage size in the United States is currently around $410,000.2 Let’s compare a 5.0% versus a 6.0% fixed-interest rate on that amount over a 30-year term.

With a 5% rate, your monthly payments would be about $2,201. At 6%, those payments would jump to $2,458, or around $257 more. That adds up to a difference of almost $92,600 over the lifetime of the loan. In other words, shaving off just one percentage point on your mortgage could put nearly $100K in your pocket over time.

So, how can you improve your chances of securing a low mortgage rate? Try these eight strategies:

Raise your credit score.

Borrowers with higher credit scores are viewed as “less risky” to lenders, so they are offered lower interest rates. A good credit score typically starts at 690 and can move up into the 800s.3 If you don’t know your score, check with your bank or credit card company to see if they offer free access. If not, there are a plethora of both free and paid credit monitoring services you can utilize.

If your credit score is low, you can take steps to improve it, including:4

- Correct any errors on your credit reports, which can bring down your score. You can access reports for free by visiting AnnualCreditReport.com.

- Pay down revolving debt. This includes credit card balances and home equity lines of credit.

- Avoid closing old credit card accounts in good standing. It could lower your score by shortening your credit history and shrinking your total available credit.

- Make all future payments on time. Payment history is a primary factor in determining your credit score, so make it a priority.

- Limit your credit applications to avoid having your score dinged by too many inquiries. If you’re shopping around for a car loan or mortgage, minimize the impact by limiting your applications to a short period, usually 14 to 45 days.5

Over time, you should start to see your credit score climb — which will help you qualify for a lower mortgage rate.

Keep steady employment.

If you are preparing to purchase a home, it might not be the best time to make a major career change. Unfortunately, frequent job moves or gaps in your résumé could hurt your borrower eligibility.

When you apply for a mortgage, lenders will typically review your employment and income over the past 24 months.5 If you’ve earned a steady paycheck, you could qualify for a better interest rate. A stable employment history gives lenders more confidence in your ability to repay the loan.

That doesn’t mean a job change will automatically disqualify you from purchasing a home. But certain moves, like switching from W-2 to 1099 (independent contractor) income, could throw a wrench in your home buying plans.6

Lower your debt-to-income ratios.

Even with a high credit score and a great job, lenders will be concerned if your debt payments are consuming too much of your income. That’s where your debt-to-income (DTI) ratios will come into play.

There are two types of DTI ratios:7

- Front-end ratio — What percentage of your gross monthly income will go towards covering housing expenses (mortgage, taxes, insurance, and dues or association fees)?

- Back-end ratio — What percentage of your gross monthly income will go towards covering ALL debt obligations (housing expenses, credit cards, student loans, and other debt)?

What’s considered a good DTI ratio? For better rates, lenders typically want to see a front-end DTI ratio that’s no higher than 28% and a back-end ratio that’s 36% or less.7

If your DTI ratios are higher, you can take steps to lower them, like purchasing a less expensive home or increasing your down payment. Your back-end ratio can also be decreased by paying down your existing debt. A bump in your monthly income will also bring down your DTI ratios.

Increase your down payment.

Minimum down payment requirements vary by loan type. But, in some cases, you can qualify for a lower mortgage rate if you make a larger down payment.8

Why do lenders care about your down payment size? Because borrowers with significant equity in their homes are less likely to default on their mortgages. That’s why conventional lenders often require borrowers to purchase private mortgage insurance (PMI) if they put down less than 20%.

A larger down payment will also lower your overall borrowing costs and decrease your monthly mortgage payment since you’ll be taking out a smaller loan. Just be sure to keep enough cash on hand to cover closing costs, moving expenses, and any furniture or other items you’ll need to get settled into your new space.

Compare loan types.

All mortgages are not created equal. The loan type you choose could save (or cost) you money depending on your qualifications and circumstances.

For example, here are several common loan types available in the U.S. today:9

- Conventional — These offer lower mortgage rates but have more stringent credit and down payment requirements than some other types.

- FHA — Backed by the government, these loans are easier to qualify for but often charge a higher interest rate.

- Specialty — Certain specialty loans, like VA or USDA loans, might be available if you meet specific criteria.

- Jumbo — Mortgages that exceed the local conforming loan limit are subject to stricter requirements and may have higher interest rates and fees.10

When considering loan type, you’ll also want to weigh the pros and cons of a fixed-rate versus variable-rate mortgage:11

- Fixed rate — With a fixed-rate mortgage, you’re guaranteed to keep the same interest rate for the entire life of the loan. Traditionally, these have been the most popular type of mortgage in the U.S. because they offer stability and predictability.

- Adjustable rate — Adjustable-rate mortgages, or ARMs, have a lower introductory interest rate than fixed-rate mortgages, but the rate can rise after a set period of time — typically 3 to 10 years.

According to the Mortgage Bankers Association, 10% of American homebuyers are now selecting ARMs, up from just 4% at the start of this year.12 An ARM might be a good option if you plan to sell your home before the rate resets. However, life is unpredictable, so it’s important to weigh the benefits and risks involved.

Shorten your mortgage term.

A mortgage term is the length of time your mortgage agreement is in effect. The terms are typically 15, 20, or 30 years.13 Although the majority of homebuyers choose 30-year terms, if your goal is to minimize the amount you pay in interest, you should crunch the numbers on a 15-year or 20-year mortgage.

With shorter loan terms, the risk of default is less, so lenders typically offer lower interest rates.13 However, it’s important to note that even though you’ll pay less interest, your mortgage payment will be higher each month, since you’ll be making fewer total payments. So before you agree to a shorter term, make sure you have enough room in your budget to comfortably afford the larger payment.

Get quotes from multiple lenders.

When shopping for a mortgage, be sure to solicit quotes from several different lenders and lender types to compare the interest rates and fees. Depending upon your situation, you could find that one institution offers a better deal for the type of loan and term length you want.

Some borrowers choose to work with a mortgage broker. Like an insurance broker, they can help you gather quotes and find the best rate. However, if you use a broker, make sure you understand how they are compensated and contact more than one so you can compare their recommendations and fees.14

Don’t forget that we can be a valuable resource in finding a lender, especially if you are new to the home buying process. After a consultation, we can discuss your financing needs and connect you with loan officers or brokers best suited for your situation.

Consider mortgage points.

Even if you score a great interest rate on your mortgage, you can lower it even further by paying for points. When you buy mortgage points — also known as discount points — you essentially pay your lender an upfront fee in exchange for a lower interest rate. The cost to purchase a point is 1% of your mortgage amount. For each point you buy, your mortgage rate will decrease by a set amount, typically 0.25%.15 You’ll need upfront cash to pay for the points, but you can more than makeup for the cost in interest savings over time.

However, it only makes sense to buy mortgage points if you plan to stay in the home long enough to recoup the cost. You can determine the breakeven point or the period of time you’d need to keep the mortgage to make up for the fee, by dividing the cost by the amount saved each month.15 This can help you determine whether or not mortgage points would be a good investment for you.

Getting Started

Unfortunately, the rock-bottom mortgage rates we saw during the height of the pandemic are behind us. However, today’s 30-year fixed rates still fall beneath the historical average of around 8% — and are well below the all-time peak of 18.45% in 1981.16, 17

And although higher mortgage rates have made it more expensive to finance a home purchase, they have also eliminated some of the competition from the market. Consequently, today’s buyers are finding more homes to choose from, fewer bidding wars, and more sellers willing to negotiate or offer incentives such as cash toward closing costs or mortgage points.

If you’re ready and able to buy a home, there’s no reason that concerns about mortgage rates should sideline your plans. The reality is that many economists predict home prices to continue climbing.18 So you may be better off buying today at a slightly higher rate than waiting and paying more for a home a few years from now. You can always refinance if mortgage rates go down, but you can’t make up for the lost years of equity growth and appreciation.

If you have questions or would like more information about buying or selling a home, reach out to schedule a free consultation. We’d love to help you weigh your options, navigate this shifting market, and reach your real estate goals!

Sources:

- Washington Post –

https://www.washingtonpost.com/business/2022/08/04/mortgage-rates-sink-below-5-percent-first-time-four-months/ - Trading Economics –

https://tradingeconomics.com/united-states/average-mortgage-size - NerdWallet –

https://www.nerdwallet.com/article/finance/what-is-a-good-credit-score - Debt.org –

https://www.debt.org/credit/improving-your-score/ - The Balance –

https://www.thebalance.com/will-multiple-loan-applications-hurt-my-credit-score-960544 - Time –

https://time.com/nextadvisor/mortgages/how-lenders-evaluate-your-employment/ - Bankrate –

https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/ - NerdWallet –

https://www.nerdwallet.com/article/mortgages/payment-buy-home - Consumer Financial Protection Bureau –

https://www.consumerfinance.gov/owning-a-home/loan-options/ - NerdWallet –

https://www.nerdwallet.com/article/mortgages/jumbo-loans-what-you-need-to-know - Bankrate –

https://www.bankrate.com/mortgages/arm-vs-fixed-rate/ - MarketWatch –

https://www.marketwatch.com/picks/as-mortgage-rates-rise-heres-exactly-how-more-homebuyers-are-snagging-mortgage-rates-around-4-01656513665 - Consumer Financial Protection Bureau –

https://www.consumerfinance.gov/owning-a-home/loan-options/#anchor_loan-term_361c08846349fe - Federal Trade Commission –

https://consumer.ftc.gov/articles/shopping-mortgage-faqs - Bankrate –

https://www.bankrate.com/mortgages/mortgage-points/ - CNBC –

https://www.cnbc.com/select/mortgage-rates-today-still-relatively-low/ - Rocket Mortgage –

https://www.rocketmortgage.com/learn/historical-mortgage-rates-30-year-fixed - MarketWatch –

https://www.marketwatch.com/picks/continuing-home-price-deceleration-heres-what-5-economists-and-real-estate-pros-predict-will-happen-to-the-housing-market-this-year-01659347993